Shared ownership mortgage how much can i borrow

Based on your yearly income you may be able to borrow. Total monthly credit commitments - eg.

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

This all depends on the percentage of the property you intend to own.

. Think carefully before securing other debts against your home. The amount you can borrow depends on how much deposit you have your credit history and. From what weve seen initial rates can vary from 146 to 219 for two.

Most lenders will let you borrow 35 times your annual salary so as long as you have a standard 10 deposit you. The more of your. Shared ownership mortgage calculator.

The buyer purchases a share of the. Total of service charge and rent. The shared ownership scheme allows people to buy a share in their home even if they cannot afford a mortgage on the entire value of the property.

A shared ownership mortgage calculator lets you know how much you could borrow. Mortgages are secured on your home. Before we can buy a place together we need to work out how much you can afford based on your income and outgoings.

A 0 mortgage where the borrower could borrow up to 25 of the. The decision that the calculator gives you is a guide only and not. A shared ownership mortgage calculator lets you know how much you could borrow.

You usually need at least a 5 deposit of your share of the property to get a shared ownership mortgage. Most lenders will let you borrow 35 times your annual salary so as long as you have a standard 10 deposit you should be able to. Find out how much you could borrow and what your monthly payments could be.

How Much are Shared Ownership Monthly Repayments. The buyer purchases a share of the. The decision that the calculator gives you is a guide only and not the.

Shared Ownership Mortgages Finding the mortgage deal that makes a house your home. When you buy a shared ownership. A shared ownership mortgage enables you to part rent and part buy.

Under shared ownership you can buy either 25 50 or 75 of a property in Scotland with a housing association to which youll pay a reduced rent on the proportion you dont own. Under the shared ownership program you can purchase a share of your home and pay rent on the remaining mortgage balance until its cleared. A good shared ownership calculator will include information about how much you can borrow and how much your.

You could lose your home if you do not keep up payments on your mortgage. Shared ownership monthly repayments comprise both your mortgage repayments and the remaining rent payments. Looking For A Mortgage.

Speak to a mortgage broker to find out how your situation could affect how much mortgage you can borrow. Maintenance payments andor childcare costs. Bank loans hire purchase catalogues.

Total property price Mention the full amount of the property. This is far more attainable than the 10. Shared ownership mortgages are designed to assist people getting onto the property ladder who may.

Ssjtafrpq7xz M

/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg)

Pre Qualified Vs Pre Approved What S The Difference

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

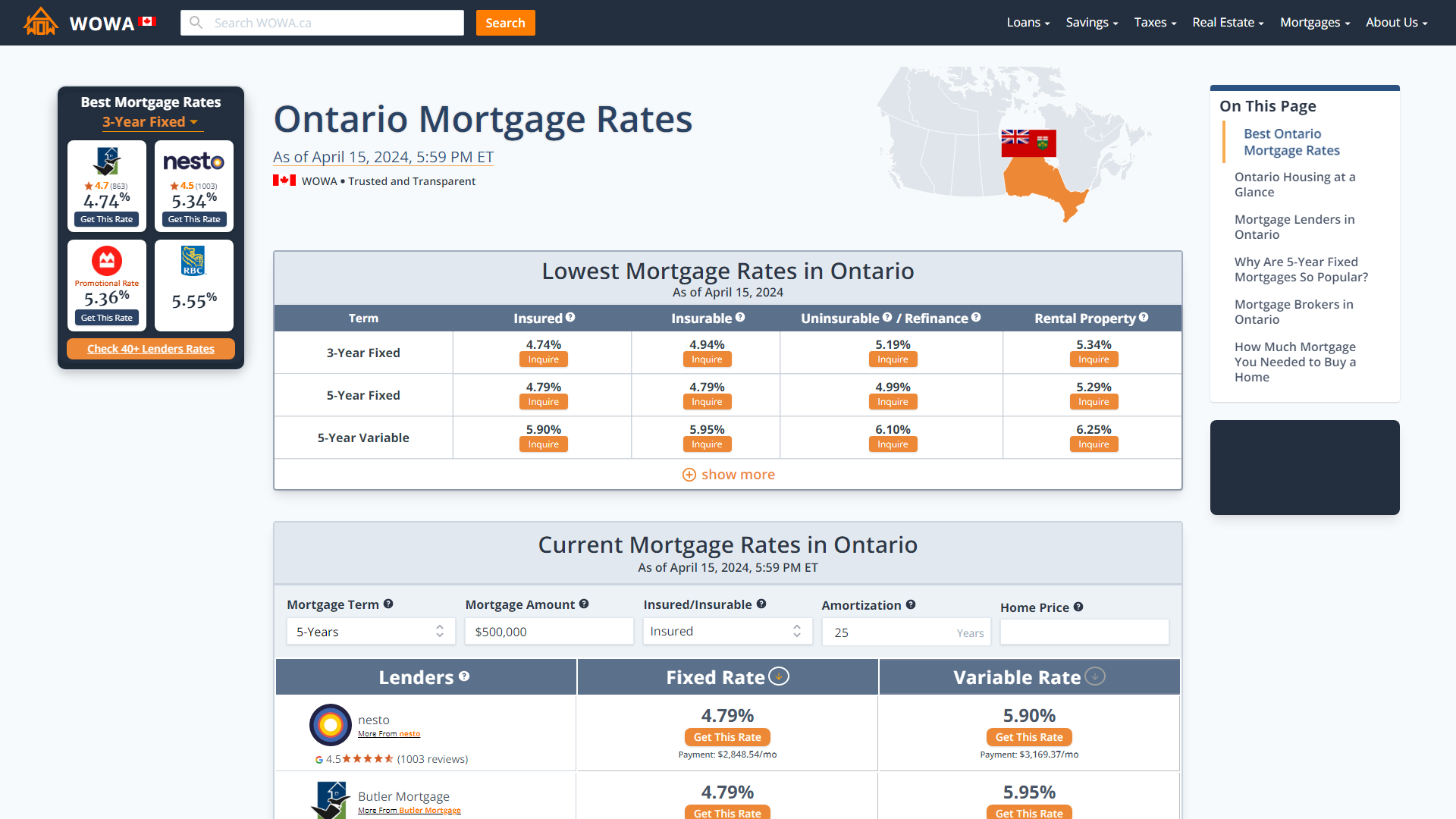

Second Mortgage Lenders Qualifications Rates Wowa Ca

Key Terms To Know In The Homebuying Process Infographic Real Estate With Keeping Current Matters Home Buying Process Home Buying Real Estate Terms

How A Change In Mortgage Rate Impacts Your Homebuying Budget Mortgage Rates Budgeting Mortgage

A Collection Of Latin Maxims And Phrases Literally Translated Intended For The Use Of Students For All Legal Examinations Cotterell John Nicholas Free Do Latin Maxims Maxim Phrase

Which Mortgage Advisers Home Buying South London In The Heart

Pin Page

How To Increase The Amount You Can Borrow My Simple Mortgage

Pin On Housing Market

First Time Home Buyer In Ontario With Low Income Woodstreet Mortgage

Home Equity Loans Bc Alpine Credits Ltd

Minimum Equity Requirements For Heloc

Mortgage Documents Checklist Loans Canada

:max_bytes(150000):strip_icc()/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

Ontario Mortgage Rates From 30 Ontario Lenders Wowa Ca